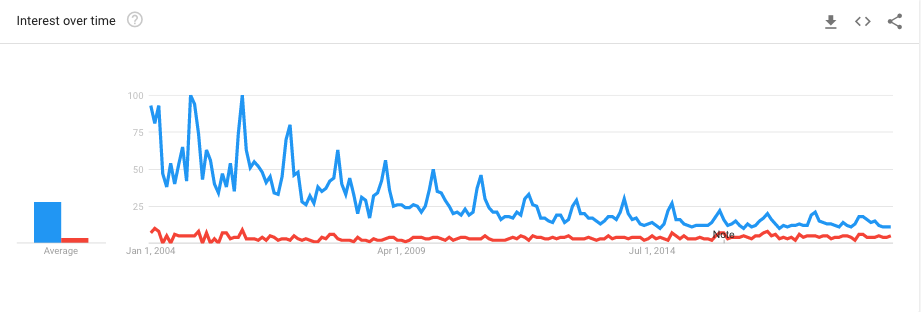

If you read our blog, you know that the sales tax landscape changed dramatically in 2018 due to the Wayfair v South Dakota ruling. Earlier this year, with no legislative mitigation on the horizon, we started thinking of this as a potential show stopper for businesses like ours; the complexity of filing hundreds or thousands of sales tax returns could easily make a business like ours not feasible.

Last month, we saw some progress as Colorado passed a law that transferred tax responsibility to third party marketplaces like Amazon.com, for independent sellers that use them.

We’ve seen some additional movement on this issue, some good, some bad.

From a recent article in the Wall Street Journal:

But states have since enacted disparate rules, which as we warned are straining small business. As a case in point, the Kansas Department of Revenue will now require all out-of-state retailers to collect sales tax no matter how much business they do in the state. This includes college students selling used textbooks on eBay and retirees hawking a few hand-made greeting cards on Etsy .

While the lack of a small-business exception can be attributed to partisan politics, this still leaves small businesses like ours exposed to harassment.

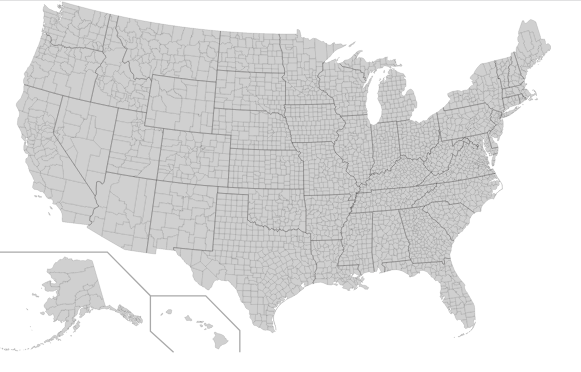

While most states have adopted South Dakota’s $100,000 small-business exception, they haven’t adjusted the sales threshold to their population size. This isn’t surprising since the Court didn’t demand it, and most construed South Dakota’s thresholds as a safe harbor.

But a $100,000 sales exemption in South Dakota with a population of 880,000 would be equivalent to more than $1 million in larger states like Illinois, Michigan and Pennsylvania. In California it would be roughly $4.5 million, nearly 10 times higher than the $500,000 exemption the state has set. A small vintner or craftsman could easily exceed these thresholds.

This makes a very good point that I haven’t seen discussed yet. The $100,000 / 200 transaction threshold seems to have been adopted across the board. For a business like ours whose average sale price is low, 200 transactions amounts to about $2,500 in sales.

Some states like Arkansas, Colorado and Illinois exclude “marketplace” sales on sites like Amazon and eBay from their thresholds for individual sellers, but many do not. And some states require marketplaces to collect sales tax for third-party retailers. The upshot is that a retailer who sells on eBay, Shopify and Amazon will exceed different state thresholds at different times.

Which raises the issue of when sellers must register with states. In many states, retailers must register immediately after they exceed the sales threshold. But Tennessee says sellers must register the first day of the third month following the month in which the dealer met the threshold, but no earlier than July 1, 2017.

What a mess! A small business like ours is responsible for being aware of all the rules; we don’t get an exception for ignorance. For example, California’s approach:

Consider California, which in June required Amazon third-party merchants to pay up to three years of back taxes. Democrats claimed they were being gracious by not requiring more.

On the more positive side, we got an email from Amazon.com recently, the first that actually provides some useful information about their sales tax system and practices.

| 23 states have passed legislation that transfers the tax responsibility from you to Amazon for the products that you sell in Amazon’s store. In these 23 states, Amazon calculates, collects, and remits tax. Amazon’s tax collection in these states is based strictly on state legislation and there is currently no option for selling partners to opt-out. On July 1, 2019, based on changes to Arkansas, Indiana, Kentucky, New Mexico, Rhode Island, Virginia, West Virginia, and Wyoming State tax laws, Amazon began calculating, collecting, and remitting sales and use tax for all orders shipped to customers in these eight states. Beginning September 1, Ohio will also join the mix. |

| Marketplace Tax Collection States |

| State |

Effective Date |

| Arkansas |

July 1, 2019 |

| Indiana |

July 1, 2019 |

| Kentucky |

July 1, 2019 |

| New Mexico |

July 1, 2019 |

| Rhode Island |

July 1, 2019 |

| Virginia |

July 1, 2019 |

| West Virginia |

July 1, 2019 |

| Wyoming |

July 1, 2019 |

| Vermont |

June 6, 2019 |

| Idaho |

July 1, 2019 |

| New York |

July 1, 2019 |

| South Carolina |

April 29, 2019 |

| Nebraska |

April 1, 2019 |

| District of Columbia |

April 1, 2019 |

| South Dakota |

March 1, 2019 |

| Alabama |

January 1, 2019 |

| Iowa |

January 1, 2019 |

| Connecticut |

December 1, 2018 |

| New Jersey |

November 1, 2018 |

| Minnesota |

October 1, 2018 |

| Oklahoma |

July 1, 2018 |

| Pennsylvania |

April 1, 2018 |

| Washington |

January 1, 2018 |

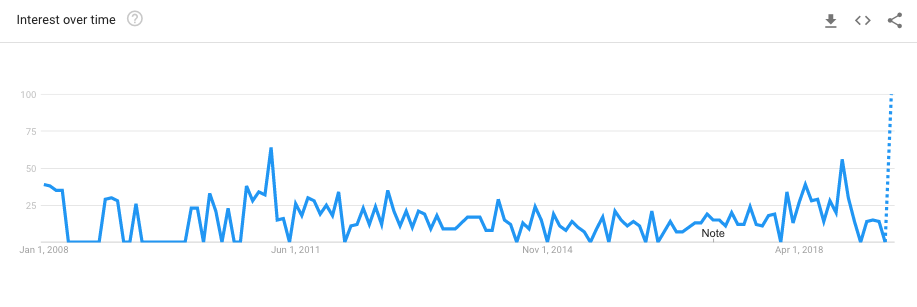

It’s a good start, but, it is only 23 out of 50 states, which means we are still responsible for the other 27 states.

Furthermore, we are still responsible for being aware of individual state policies, tracking sales to individual states, implementing potentially hundreds or thousands specific tax jurisdiction sales tax collection rates, and potentially submitting multiple returns to individual states with complex calculations for sales taxes that are due in individual jurisdictions.

While about 2/3 of our sales go through Amazon now, retaining a sales channel independent of any 3rd party merchant is important for independence, and the off-chance that they arbitrarily decide to suspend our account. The danger is that if marketplaces like Amazon.com take responsibility for collecting sales tax and filing returns, while the states don’t figure out a streamlined system for independent merchants, it could further tip the scales away from independent sellers and give more power to sellers like Amazon.com, some that few would argue is a desirable outcome.

I hope the states and federal government get off their collective duff and create a solution to this problem soon.