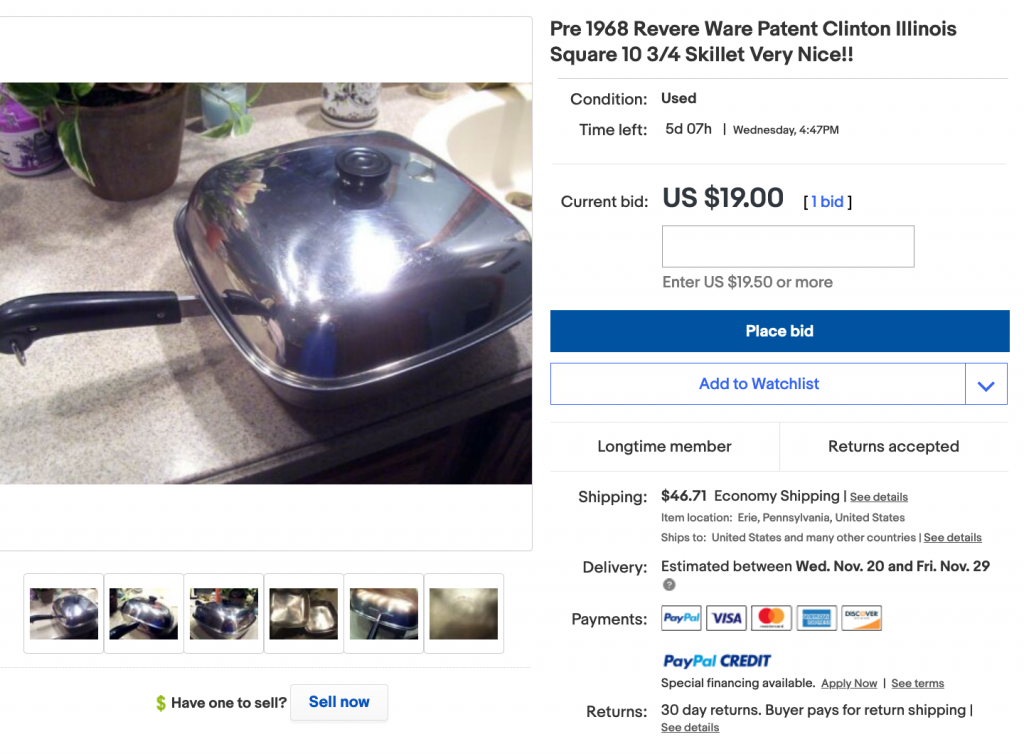

Another very inexpensive square skillet.

Update:

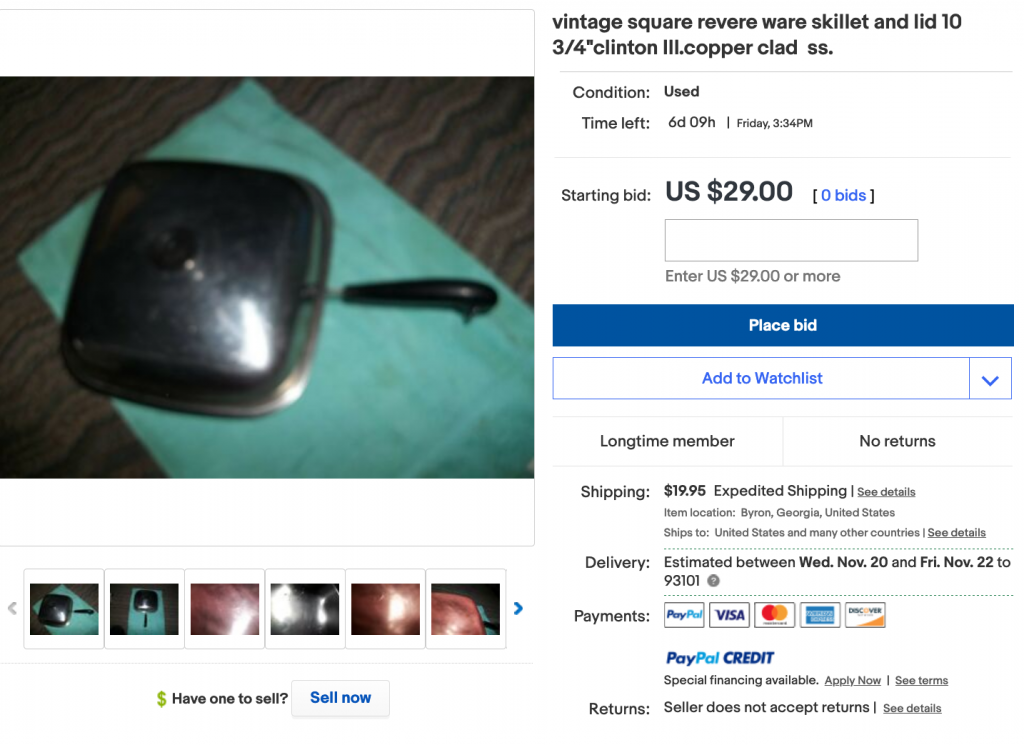

Another one about the same price.

Another very inexpensive square skillet.

Update:

Another one about the same price.

According to the Denver Post, Colorado’s particularly strict law on sales across tax jurisdictions is having a negative effect on eCommerce.

Colorado’s law can be described thus:

Signed by Gov. Jared Polis last week, House Bill 1240 takes effect Saturday. The bill, an updated, baked-into-the-Colorado Revised Statutes version of rules originally rolled out by the Department of Revenue last year, makes destination-based sales tax the law in the state.

That means regardless of where a business is located, if it ships products to another city, county or town in Colorado, it is required to calculate, collect and pay the sales taxes for that jurisdiction. That includes accounting for overlapping boundaries and special taxing districts such as RTD.

Here is one example of what such a thing looks like to a small business:

In April, Hessemer sold a sample-sized product into the self-collecting home-rule town of Winter Park. The sale earned her $1.60 in profit. She owed $1.38 in taxes, but was told she needed to purchase a $60 business license to pay that. Instead, she plans to stop selling in Winter Park, something she considers a loss for her and for eco-conscious customers there.

Ouch!

As I mentioned in our last updates on this topic (here and here), while the solution seems to be set for businesses that sell through third party marketplaces, like eBay and Amazon.com, which now collect sales tax on behalf of their sellers. But the outlook is still ominous for sellers that sell through their own websites, like us. Like us, many businesses may sell through Amazon.com but are unwilling to put all their eggs in one basket, as Amazon.com has been known to ban sellers or compete with them on a whim.

Colorado isn’t the only state that is making it hard for small businesses. Kansas seems to stand alone at the moment in having no economic nexus for online sales into the state, meaning, the first dollar you sell into the state requires that you collect sales tax and submit a tax return. Most other states that have passed legislation requiring online sellers to collect sales tax at least exempt the first $100,000 or more (or a given number of transactions), meaning, you have to sell at least that much before you are required to collect sales tax.

We are still hoping for some kind of a national solution to this problem. But alas, no further progress on that to date.

I suppose this was bound to happen. We’ve written before about retail arbitrage, where some eBay sellers relist items available on Amazon.com for a higher price than you might otherwise pay there, and simply have the item “drop shipped” to you from Amazon.com, when you purchase on eBay. This essentially means just purchasing the item on Amazon.com and entering the eBay buyers address as the shipping address.

Of course, there are websites that providing information on setting this up.

The most recent twist to this is that we’ve found listings for our parts now in Spanish.

Note that eBay’s official policy is that this practice is not allowed:

Drop shipping, where you fulfill orders directly from a wholesale supplier, is allowed on eBay. Remember though, if you use drop shipping, you’re still responsible for the safe delivery of the item within the time frame you stated in your listing, and the buyer’s overall satisfaction with their purchase.

However, listing an item on eBay and then purchasing the item from another retailer or marketplace that ships directly to your customer is not allowed on eBay. In such cases, we may remove your listings from search, display them lower in search results, or remove them completely from the site. We may also limit, restrict or suspend your ability to buy, sell, or use site features on eBay, and you could lose any special status and/or discounts associated with your account.

A more nefarious twist to this practice is that some scammers use stolen credit cards to purchase the items from Amazon.com to fulfill the purchase on eBay; this is called triangulation fraud.

The bottom line is that, it is generally a bad idea to buy our parts on eBay for a number of reasons.

Please buy just from our website or from our store on Amazon.com. We are the only authorized sellers of our parts and we don’t sell on eBay. If you buy from us, we guarantee a good experience and will replace your part if it is defective.

We get asked a lot whether our cap + trigger set will fit various kettles. I just thought I’d point out that we created a page on this exact topic: How to determine the size of your Revere Ware tea kettle.

In short, our cap plus trigger are made for the 2 1/3 quart size, that looks like this:

Some have the metal disk at the top of the cap (our replacement caps don’t) and some do not. The notable characteristics of this kettle are the handle that attaches directly to the kettle on the back end and to a metal riser on the front end.

Compatible kettles of this size were made under various model numbers over the years: 2701, 2901, 2722, and 2712. The problem is that these numbers do not appear on the bottom of the kettle. The numbers that do appear there, are pretty worthless to identify the model.

We’ve been told by some customers that the cap works fine on the 3 1/2 quart model. The trigger definitely won’t. This model is characterized by the handle which has both ends of the Bakelite in contact with the kettle.

You can order a 3D printed trigger for this kettle from Shapeways. We don’t sell the cap separate from the trigger unfortunately, so if you are ordering for the 3 1/2 quart size, your going to get an extra trigger you can’t use.

We recently learned about a bill by Senators Wyden, Shaheen, Hassan, and Merkley, that would mitigate the online sales tax issue, for a while. Senate bill S2350 proposes:

Online Sales Simplicity and Small Business Relief Act of 2019 This bill prohibits states from imposing a sales tax collection duty on a remote seller for any sale that occurred prior to June 21, 2018. A “remote seller” is a person without a physical presence in a state who makes a sale in the state. A state may impose a sales tax collection duty on a remote seller only for a sale that occurs after January 1, 2021. In the case of a small business remote seller (no more than $10 million in gross annual receipts in the United States), a state may not impose a sales tax collection duty on any person other than the purchaser if the sale is made (1) on or after June 21, 2018; and (2) before the date that is 30 days after the states develop and Congress approves an interstate compact, applicable to the state and sale, governing the imposition of tax collection duties on remote sellers.

I’m guessing the expiration is just to make it easier to swallow now, so some longer-term debate about the proper way to solve the online sales tax issue for small businesses can happen while small businesses have some protection from abuse by the states.

Introduced in early August, so far this bill has only been “read twice and referred to the Committee on Finance. (on 7/31/2019).”

We can only hope this bill is given some serious consideration. A moratorium, even a short one, is welcomed at this point.

In the long term, I think some reasonably revenue cap is a good solution to protecting small businesses from significant compliance costs. Even with a much higher state sales revenue threshold, requiring sellers to monitor sales into every state, and then, on a dime, start collecting sales tax to customers in that state, has serious issues. From where we sit, the $10 million revenue threshold looks pretty safe, but other businesses may still cry foul.

It doesn’t happen all that often, but sometimes the spot welds where the “wings” of the metal handle spline connect to the pot do fail, and the entire handle falls off. Given these two auctions I found on eBay, I guessed that is what happened.

However, looking at the close-ups of the ends of the metal splines, these don’t appear to have every been welded onto a pot. And the Bakelite part of the handles appears brand new.

It’s interesting that there is an extra bulge right where I presume the spot welds would be placed, perhaps as sacrificial material given that the welding process likely vaporizes some of the stainless steel.

I have no idea what the provenance of these replacement parts is, but they are likely not that useful as a full spline + handle replacement. As our tests have shown, it is pretty hard to weld the handles back on with traditional arc welding equipment, as it wants to burn a hole through the relatively thin pot / pan walls, and brazing the handles back on isn’t an entirely aesthetically pleasing solution.

It is likely that they had a special spot-welding system in the factory for this, that you don’t typically find in a weld or machine shop.

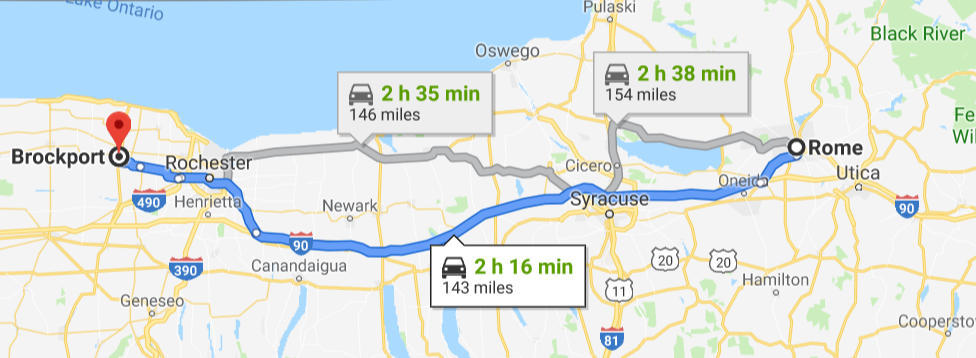

My guess is that these were brought home by someone that worked in the relatively nearby Rome NY Revere Ware factory.

It’s close enough that this seems plausible.

eBay is the latest selling platform to automatically collect taxes based on the buyers location, and handle filing of returns and submitting payment to the proper tax authorities. Here is what we received from them today:

While this doesn’t effect us directly (we don’t currently sell on eBay, but many of our parts are sold there by others), we consider it good news that the momentum towards good solutions to the potential for a sales tax apocalypse for small sellers continues to grow.

The biggest worry is still, what happens for sales on our own website. Simply having to prove that we don’t have to file a sales tax return for even a small percentage of the 10,000+ jurisdictions in the US would make our small business unsustainable. If any states decide to start bullying small businesses and send out sales tax compliance notices, the onus would then be on us to prove we didn’t have to file a return.

A similar thing happened to us once with our business license. We had a business license in one town, and our PO box in the neighboring city. The neighboring city send us a letter demanding that we obtain a business license in their city because we were doing business there. For those unschooled in the typical rules around business licenses, simply receiving mail in a location is not a such qualifying business activity. It took two successive responses to get them to give up. I’ve also seen this for another business, where the state of California demanded the business register in the state and pay the LLC tax, simply because the headquarters of the brokerage company (TD Ameritrade) happened to have a California address.

The general concept is called regulatory overreach, and many states, especially California are not shy about doing it.

So we continue to wait and hope that a well crafted and thorough solution comes along that will reduce the fear of a huge tax compliance burden for independent sales that don’t go through a third party marketplace. Otherwise, there will only be third party marketplaces left to rule the roost.

It looks like more states have passed legislation mandating marketplaces like Amazon to collect taxes, and submit returns, on behalf of third party sellers. Here is what we just received from them:

Dear seller,

Based on changes to Arizona, California, Colorado, Maine, Maryland, Massachusetts, Nevada, North Dakota, Texas, and Utah States tax laws, Amazon will begin calculating, collecting, and remitting sales and use tax for all orders shipped to customers in these states on October 1, 2019.

Your existing tax calculation settings, order details, and payments reporting will update automatically to reflect this change. Changes to your tax settings or seller account are not required based on the state law changes. However, you may consider working with your tax advisor to determine if your business has any other ongoing tax remittance or reporting obligations.

Answers to common questions are available in the Marketplace Tax Collection FAQ.

For more information from Amazon or links to each state resource, see Marketplace Tax Collection FAQ

Thank you for selling on Amazon.

Regards,

Amazon Services

Since that now includes our home state, California, that is a relief. I imagine now it won’t be long until all states require this.

But is still leaves us open to abuse from state tax authorities for sales through our website. We still await a solution to that problem.

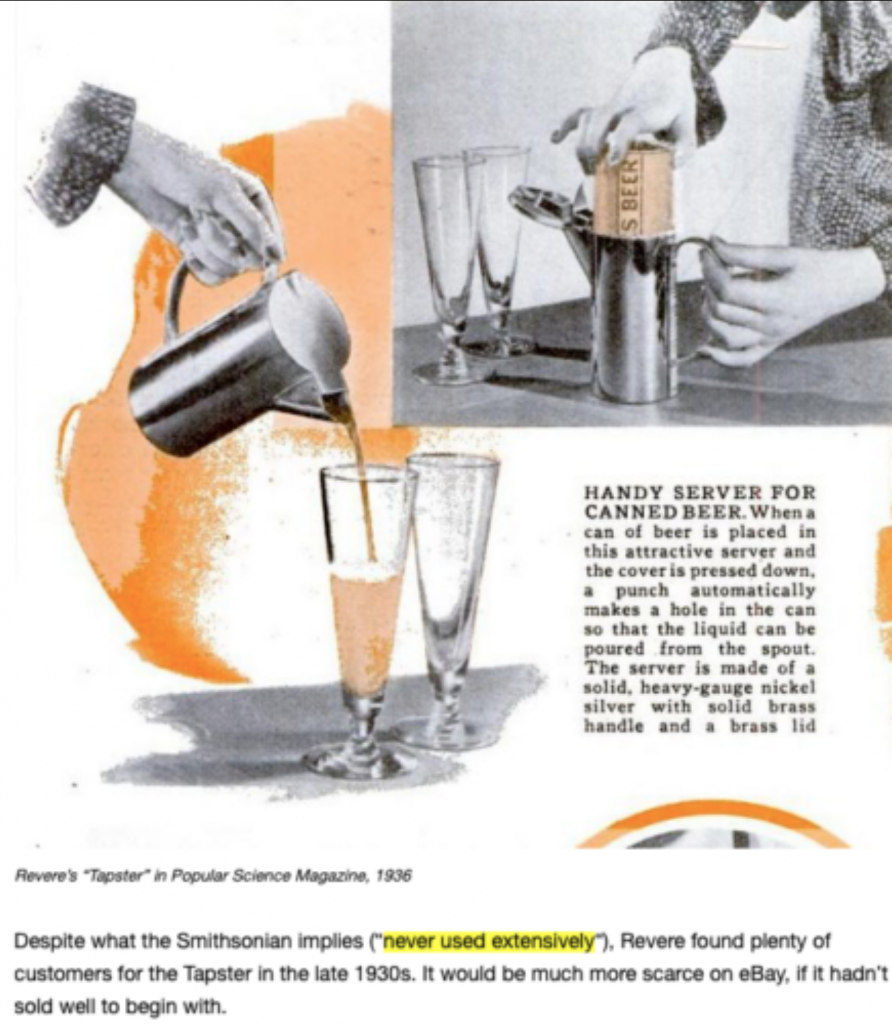

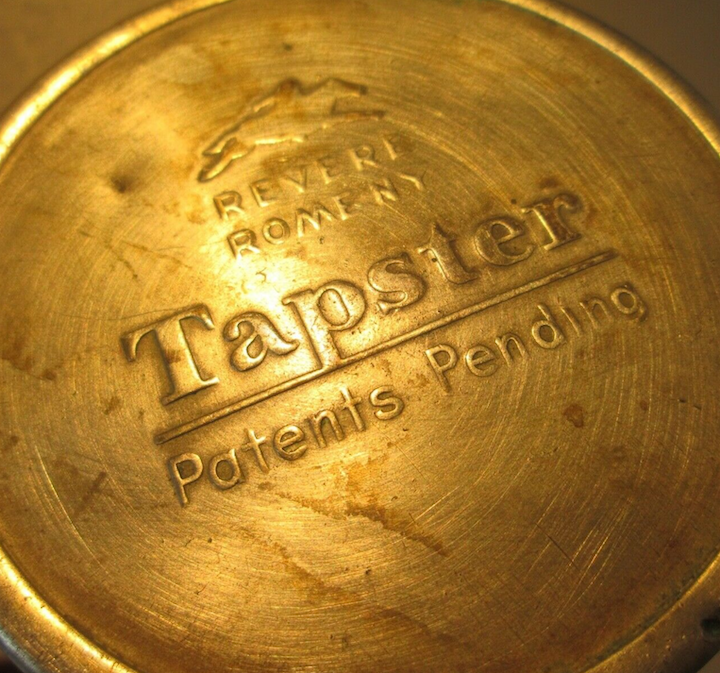

My first reaction to the Revere Tapster was, “How elegant!” Take a boring can of beer and serves it like a fine beverage. You insert a can of beer, and close the lid, which punctures the can, and allows you to pour it out of a beautiful looking server.

It’s available for purchase at a very reasonable price.

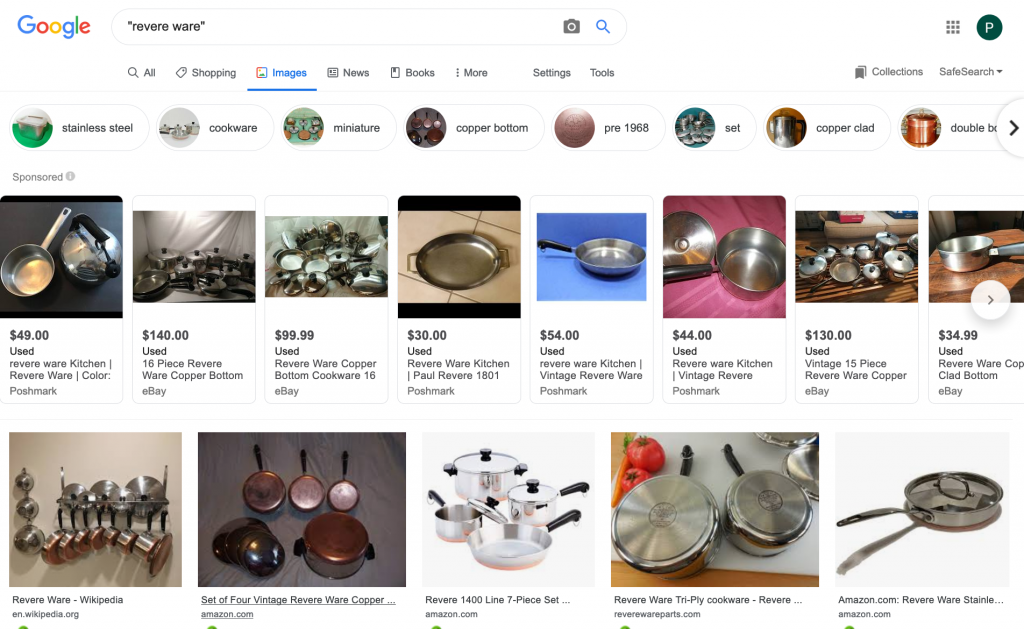

Having turned 10 years old as a resource and provider of replacement parts this year, it is apt that we engage in a little self-reflection on what we’ve accomplished. Here’s a little tidbit that we discovered recently. Search Google for “Revere Ware” and select images.

Of the roughly 300 images returned, 39 of them, or about 13% are from our site or our revereware.org site. I suppose then by at least that measure, we are the Internet’s leading authority on Revere Ware.