We’ve blogged a number of times on the coming sales tax armageddon that is coming due to the South Dakota vs Wayfair Supreme Court decision, unless something is done.

A new law in Colorado is the first I’ve seen that attempts to address this issue. This quote from a member of the Colorado Senate does a good job of describing the issue:

Colorado has 344 taxing jurisdictions that include cities, counties and special districts, and 638 unique tax rates, Meneghel said. It would be a huge operational burden on small businesses to file up to about 600 new tax returns each month without the grace period that the law provides, he said.

Colorado’s solution is:

The new law also provides that businesses that sell through a marketplace facilitator such as Amazon or similar online entities are exempt from collecting and remitting sales tax; that responsibility will fall to the marketplace entity beginning Oct. 1.

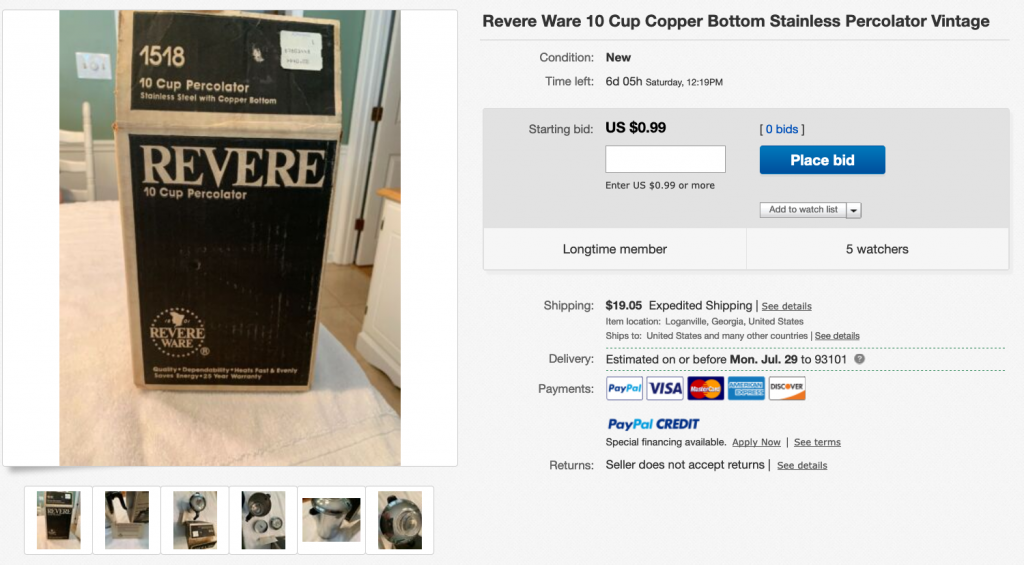

That’s exactly one of the solutions we were hoping for. Amazon.com for one, doesn’t have a great system for helping their 3rd party Marketplace sellers handle sales tax. It is incredibly difficult to just find out what sales occurred where. They, on the other hand, would have no problem collecting sales tax, and submitting returns, for every jurisdiction in the US, which they probably already do.

In addition to requiring marketplace facilitators to collect sales tax on their sellers behalf, there are a couple of other solutions I can think of.

- Instead of just a threshold of sales into a state to trigger collection of sales tax in that state, have a federally mandated threshold, below which any seller is only required to collect sales tax in the jurisdiction where they are located.

Many, if not most business licensing schemes work with a gross receipts threshold; say, below $250,000 in gross receipts, you pay a flat business license fee; above it you pay a percentage of gross receipts as a business license fee. Why not have such a threshold for engaging sales tax complexity?

But this is really just a partial solution. There will be a huge burden placed on a business the minute they surpass the threshold. But at least that would allow some small businesses to avoid the sales tax trap.

- Create a federal technical system for collecting sales tax and distributing it to the right jurisdictions

Imagine a Federally mandated tax calculation system / service you could plug into any e-commerce software that would calculate the exact sales tax due for where an order is shipped. A merchant would then simply pay the federal tax collection agency the total sales tax collected and they would distribute it to the proper jurisdictions.

Okay, so governments don’t have a great track record when it comes to implementing technology systems. If a Federal law existed that removed the requirement for businesses filing returns in every jurisdiction for which sales tax was collected, in lieu of using a private service that offered the above solution, that would enable private services to start offering such a collection and distribution service. I would gladly pay a reasonable fee for a service like this.

The point is, something needs to be done to allow small businesses to simply exist in this new sales tax reality. And imagine how much wasted time and money on sales tax compliance businesses of all sizes could recoup with a setup like this.